Life Cover Personal & Business

- By John Miller

- •

- 11 Dec, 2016

- •

Leaving a lump sum to the people who matter most

Leaving a lump sum to take care of your business partners

Creating an ongoing monthly income for your family

Accidental Death – another option

Want to know more?

If you would like to review your personal insurance protection, talk to your adviser or call Quadrant Today on

Who said financial skills are just for grown-ups? Teaching kids about money provides them with a toolbox that will be incredibly useful through life in making confident and informed decisions in the future.

And its importance goes well beyond money itself. It can be the foundation upon which key skill sets are built, such as ethics, empathy, organisation, time and risk management. Of course, the style and approach is personal to every parent, but if you’re not sure where to start, check out these handy tips.

When life throws a curve ball or two and you need to claim on your insurance, having the knowledge, expertise and guidance of your insurance adviser makes all the difference.

It’s your adviser’s job to guide you through the process; to help you understand what you can claim; to represent your interests with the insurance company; to make sense of the various forms and process. Ultimately, they’re there to make claim time as stress-free as possible and to help you receive your pay-out in a timely manner.

For example, what if you were to suffer a stroke, heart attack or cancer, and survive - but not be able to work ever again?

Quadrant has a whole range of insurance products designed to alleviate the financial stress on you and your family. We all need to reconsider our insurance needs from time to time, especially at pivotal times in our lives, such as marriage, starting a family, buying a house or becoming self-employed.

It's also important to take account of the escalating costs of medical treatment and rehabilitation, and the amount you might realistically need to properly recover from serious illness or injury, and provide for your family.

Consider the following types of insurance cover available to you:

People insure their car, furniture, luggage and even their pets - but often neglect to insure their hard-earned lifestyle. Left uninsured, which would be the greatest loss?

Purse strings may be tight today, but you'll still want to keep your long-term financial goals on track. We all like to think “it’s never going to happen to me”, but accidents and illness can happen. And some of us die too soon. Life can be unpredictable, which is why many of us decide to protect ourselves with some form of life insurance and disability.

Our Services

Insurance

Personal

- Life

- Trauma/Living Assurance

- Total and Permanent Disablement

- Income Protection

- Health

- Mortgage Repayment

- Waiver of Premium

Business

- Key Person

- Partnership

- Debt Protection

- Locum Cover

- Business Overheads

Companies who we place business with

- Accuro

- AIA New Zealand Ltd

- Resolution Life

- Asteron Life

- Chubb Life

- Fidelity Life

- nib nz Limited

- Partners Life

- Southern Cross

General Insurance

Personal

- Personal

- Home

- Contents

- Motor Vehicle

- Construction

- Boat

- Transit cover

Business

- Commercial building

- Plant

- Contents

- Tools of Trade

- Business Interruption/Loss of Profit

- Marine/Transit

- Liability

- Professional Indemnity

Companies who we place business with

- Ando

- NZI

- QBE

- Vero

- Delta

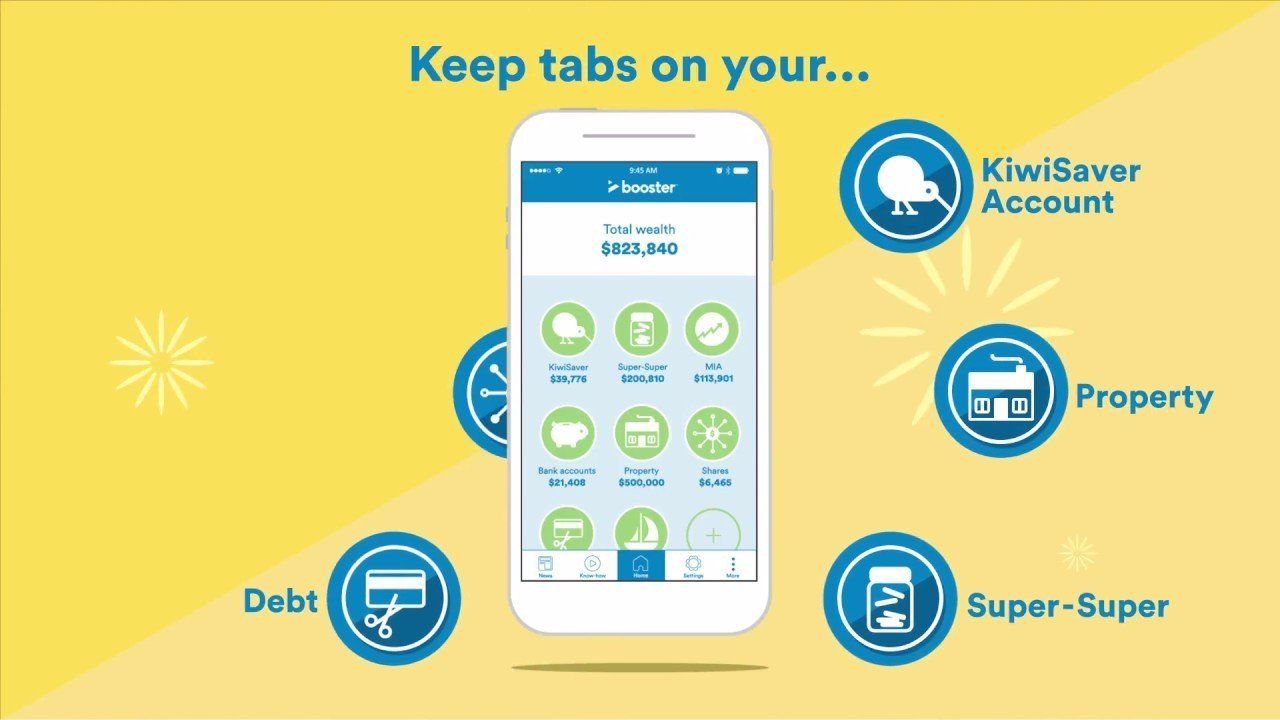

KiwiSaver

Companies who we place business with

- ANZ

- AMP

- Booster

- Fisher Funds

- Generate

- Milford Asset Management

- Select KiwiSaver

Other Services

- ACC

- Group Life/Health Insurance

- Group KiwiSaver

- All Investments

- XE Money Transfer

Health Insurance

KiwiSaver

Contact Info.

Phone: 021 325 190

Online Enquiry

Footer contact form

We will get back to you as soon as possible.

Please try again later.

© Copyright 2022 | All Rights Reserved | Quadrant Financial Services (2020) Ltd Trading as SHARE